How to Start Your Credit History

Your credit history and your resulting credit score are key resources for your financial life. It is an opportunity for you to take responsibility for your finances and reap the benefits of lower payments and cash rewards.

Credit Basics

Starting at 18 years old, one can start building their credit score. Your credit score is a number given to you by credit scoring agencies that determine what kind of risk you are to lenders.

A high score is good and means you are a good credit risk. A high credit score can mean more favorable terms on any future loans and it means you often pay less for the money you borrow.

A low score, on the other hand, is bad and should be avoided at all costs. A low score means you are a bad credit risk and will most likely result in high-interest rates and more money out of pocket for financial obligations.

So it pays to have a higher credit score.

If you’re over 18 and in school; chances are you are already building a credit score by taking out student loans. Student loans were taken out for school often do not start accruing interest until you are finished with school because they are subsidized by the Federal Government, Thanks, America!

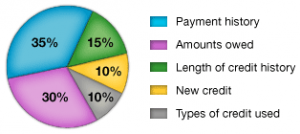

5 Things That Affect Your Credit Score

Payment history and loan balances make up the lion’s share of your credit score. This shows that making regular payments and maintaining low balances matter the most when talking about credit.

Payment history and loan balances make up the lion’s share of your credit score. This shows that making regular payments and maintaining low balances matter the most when talking about credit.

For young people, your length of credit history will be a weakness until you get your credit established, which can take 6 months to a year.

New credit is affected when you signup for a new loan or credit card and will temporarily lower your score when applied. Types of credit is less important for young people as you won’t have multiple sources of credit until you get more established.

Credit Cards

Credit cards are one of the best tools for building credit if you are disciplined in your spending. Many credit cards offer signup bonuses and cashback rewards to incentivize you to sign up. In this next part, we will talk about how to use credit cards to effectively to build your credit history.

Picking Your First Card

I signed up for my first credit card on my 18th Birthday in 2015. I chose the Discover it® card for students because I thought it would give me the best chance of being approved. Luckily, I was approved right away after I answered a series of questions about my financial health.

Here are a few of the questions you will probably have to answer:

- What is your income? For this, estimate what kind of money you are bringing in from all sources including what money if any you receive from parents, work, and school. If you don’t have any income you probably shouldn’t be applying for a credit card.

- What is your housing payment? If you are in school and your rent doesn’t come out of your own pocket you should enter zero under this.

- How much in assets do you have? Put down how much money you have in the bank and any other saved monies. They might also ask if you have a checking and a savings account.

Credit card companies are risk takers on the probability of you paying back your balances. They ask for these numbers to estimate your yearly cash flow to determine if you will have the money to pay off your balances.

I’m Signed Up! Now What?

When you get approved for a card, they will send you a packet in the mail to your address. In the packet, you will find your card and the agreement in fine print that binds you to your card. Save your agreement and put it in a safe place. Finally, you should be able to activate your card and start using it.

Important Things to Note…

Credit Cards Should Facilitate Your Normal Buying Activities

Your spending should not go up after signing up for a credit card. It should merely be an extension of your normal buying activities. Credit cards are great because they offer people a chance to show that they are responsible for handling money and can get rewarded for doing so.

Many credit card companies have signup bonuses and cashback rewards for using their card. Treat this as a reward for doing what you are supposed to with your cards. Don’t let these rewards act as an invitation for you to spend more.

Pay Off Your Balance Every Month

This is very important. Don’t screw around and spend money you don’t have. That is how you get into trouble. Be Spartan in your spending. Spend within your means and make sure you have enough in the bank to cover your credit card balance every month.

Not paying your balance off can result in late fees and interest charges. Credit card business models are built on people not paying their balances off every month.

Credit Cards Require Discipline

If a business spends more than they take in they will eventually go out of business. The same is true for individuals. Credit cards are a big responsibility and should be taken seriously. To avoid the pitfalls of credit cards you should:

- Pick a card with $0 annual fee.

- Pay off your card balance a week ahead of its due date every month.

- Never spend more than what you have in your bank account.

- Spend as you would normally; don’t overspend just because you have access to credit.

Paying off your balance a week ahead of time leaves a cushion for problems with your bank receiving payment. It is always a good idea to give yourself a time cushion to be able to take care of any hiccups.

Don’t Sign up for Other Cards

Signing up for other credit cards right away will trigger hard inquiries to your credit report which will damage your score. Wait to be approved for your first card and establish yourself with that card. It only makes sense to look at others when you have a physical credit score and at least 6 months with your card under your belt.

Rewards

My strategy for rewards is to let them accumulate until the holiday season so I can spend them on presents for friends and loved ones. If you do this you might be able to avoid overspending this December which will help you start the new year off right.

Cheers.